“Out of clutter, find simplicity. From discord, find harmony. In the middle of difficulty lies opportunity.” - Albert Einstein

When I was kid, my bedroom was usually a complete disaster. Clothes strewn across the floor, a dirty pillowcase, unwashed bed sheets, an old cereal bowl with a small remaining circle of near-petrified milk. It’s not that I wanted it to be this way, but when my high school pea-brain contemplated tidying up, I was quickly distracted by the next song on my Toad the Wet Sprocket CD.

Most of us were like this as kids and it typically doesn’t change, until a force - namely, a stern father or mother - exerts his or herself to move the child from inaction to action.

This is a fairly simple illustration of Einstein’s 2nd law of thermodynamics, or entropy. The funny thing about laws, though, is they don’t go away very easily. As we continue to age, develop our careers, and grow our families, life becomes a more complex challenge.

Simply put, our lives again move toward entropy, or disorder.

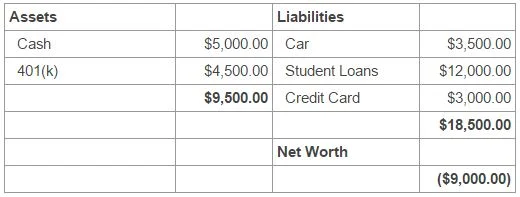

It shouldn’t surprise you then that your financial life will likely experience the same thing. What often starts as a relatively simple financial balance sheet a few years after college:

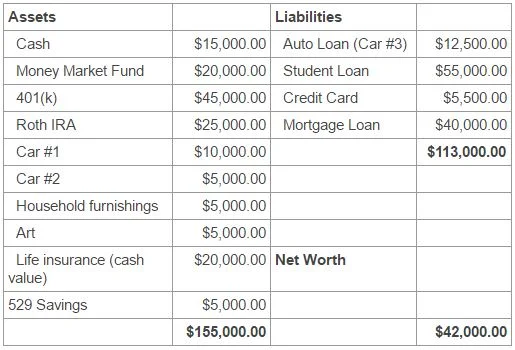

Quickly turns into this:

There’s nothing inherent in either financial balance sheet that suggests disorder. Simply because you may have a wide variety of assets and reasonable liabilities doesn’t mean your financial life is out of whack.

But with every asset and every liability there is more opportunity to lose control. Each one will demand additional time to manage (Cash, IRA, 401(k)), insurance to protect (Cars, Art, Home Furnishings), income to pay down (Student Loans, Credit Card), or taxes to pay (Property).

Like I said, this isn’t a bad thing, but one’s financial picture tends to move to a state of disorder without discipline and nurturing. Here are a few examples:

- You may run out of cash before your monthly debt payments are made

- Unchecked 401(k) or IRA investments may get out of line with your risk tolerance

- College savings may go by the wayside in an effort to utilize extra cash

- Debt payoff priorities get clouded as opportunities for acquiring assets increases

Perhaps more importantly, the need to manage a growing financial balance sheet can cause you to lose control of other, more meaningful elements of your life, such as making time for exercise, investing in your personal education, playing with your kids, or going on a date with your spouse.

I’m not writing this post to propose solutions. Rather I want to remind you that physical laws, such as entropy, are pretty hard to escape, and they will surely creep into your financial life.

Recognize this and consider its long-term implications, and you’re one step closer to finding simplicity out of clutter.