Busy intelligence gatherers

Welcome to Part 2 of 401(k) Workshop: Make Sense of Your Current Financial Status. I’m committing a great deal of time to this series and I hope you’ll find it helpful.

Your 401(k) is an incredibly powerful tool to help you build wealth; however, it’s not perfect. Many people have expressed confusion and frustration with how to choose their investments, how much money they need in their 401(k), and an array of other issues. In addition, there are probably some unknown elements of your 401(k) that are working against your financial success!

This series provides a step-by-step process for evaluating your 401(k)’s purpose (it’s about more than just “save up a bunch of money”), understanding how your current financial situation affects your 401(k)'s future growth, and developing a plan for getting the most out of your 401(k) to better provide for your financial future.

Part 2 - The CIA and “Intelligence” Gathering

My father spent his entire career as an officer with the Central Intelligence Agency. He took great pride in serving his country and the men and women working to protect it. To this day I don’t know many details of my father’s job, but I know it involved collecting intelligence. As a youth I was certainly curious about my dad’s work (I knew where he worked, nothing more), but the nature of his work was sensitive enough that defending his colleagues and the agency’s mission overrode the curiosity of his children.

I’ll never forget the day I decided to break “the big secret” to my best friend. “He’ll never believe how cool it is that my dad works for the CIA” I thought. In hushed tones, I whispered the secret to my friend. His eyes widened as he exclaimed, “Oh my gosh. My dad does, too!” I guess when you’re living in D.C., you’re not as special as you sometimes think you are.

In the 1959 dedication ceremony of CIA headquarters, President Dwight Eisenhower said:

"In war nothing is more important to a commander than the facts concerning the strength, dispositions, and intentions of his opponent, and the proper interpretation of those facts."

"No task could be more important. Upon the quality of your work depends in large measure the success of our effort to further the nation's position in the international scene.”

My father’s work in the CIA began and ended with the facts, with intelligence. On the international stage of national security, few things were more important than having the facts and making calculated decisions based on those facts.

Evaluating Your Current Financial Situation

As discussed in Part 1, your financial information comes from a variety of sources, including:

- Checking accounts

- Savings accounts

- Latest employer pay stub

- Investment accounts (including your 401(k) statement!)

- HSA accounts

- 529 College Savings accounts

- Credit cards

- Auto loans

- Mortgage(s)

- Tax returns

Part 2 is all about the importance of collecting data and turning it into meaningful intelligence to help you make better 401(k) decisions. By the end of this article you’ll have a process for taking all the financial documents you’ve gathered and digesting them into a few simple but highly valuable financial metrics. These are:

- Creating a simple budget

- Optimizing your cash flow

- Creating a personal financial statement

After going through this process, you’ll still be faced with a big question: knowing how much to put into your 401(k). I assure you, Parts 1 and 2 are essential steps to answer that question. We’ll cover this thoroughly in “Part 3: Develop Your 401(k) Investment Plan.”

Create a Simple Budget

Once you’ve gathered all your necessary financial account information, start by creating a budget. You may feel like you don’t need a budget, or that they’re only for people who have major financial challenges like excessive debt.

Whatever your reasoning might be, stop it! Your 401(k) needs three things to grow: time, discipline, and money. Without a budget you’ll never know where your money is disappearing to; money that could otherwise be used to build wealth.

Creating a budget is not difficult. I typically recommend one of a variety of online budgeting tools, such as Mint or You Need a Budget. These are easy to use and make monthly budgeting a breeze, especially with account aggregation features which allows you to see all your financial accounts like credit cards, checking accounts, and savings accounts in one place. Creating a budget for your first time using one of these tools shouldn’t take more than a hour or so.

How do you know your budget is on the right track? A simple budgeting framework might help. It's called the 50/30/20 rule. It says that 50% of your expenses should be for "Essentials" (shelter, heat, food, clothing), 30% for "Non-Essentials" (fast food, vacations, entertainment), and 20% for "Saving and Charity."

Budgets have many benefits, but I want to emphasize that budgeting isn’t about straining at each and every dollar leaving your checking account. The budget’s primary benefit is to serve as a “check”--a way of keeping tabs on your overall spending each month. Don’t worry too much about overspending here and there on groceries or eating out in any given month.

Because of the automated nature of tools like Mint, time spent on monitoring your budget shouldn’t be more than 30-40 minutes a month, with a 15-20 minute review with your spouse.

Optimizing Cash Flow

A main goal of your budget is to understand whether or not you have money left over after your expenses are paid. This is your net cash flow. Net cash flow should not be maximized, but optimized.

Maximizing your cash flow can be done by cutting a variety of monthly expenses (no restaurants or weekend movies for you!) Not only does this make people miserable and a bit "anti-budget", but it’s not necessary. Instead, aim to optimize your cash flow by ensuring you allocate the appropriate amount to your 401(k). This won’t be difficult to do, since most 401(k) contributions come out of your paycheck before they hit your checking account!

If you reach the end of each month with your 401(k) (and other financial goals) funded, your essential expenses met, and a carbonated beverage in hand while watching a football game with only a few dollars of cash flow remaining, consider your cash flow optimized.

Create a Personal BALANCE SHEET

Most of us have heard of a balance sheet. A balance sheet provides a snapshot of a company’s current financial position at a point in time.

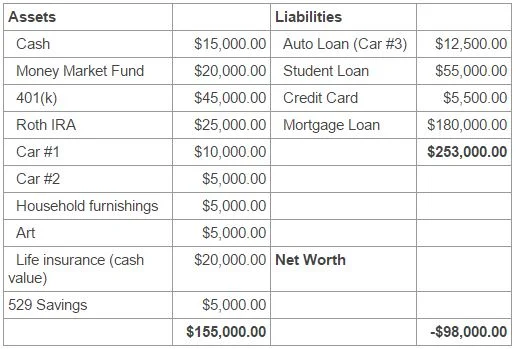

It’s helpful to also consider your own Personal Balance Sheet. It considers three main areas of your financial position:

- What you OWN (Assets)

- What you OWE (Liabilities)

- What’s YOURS (Net Worth)

By determining what you own, what you owe, and subtracting the two, you reach what’s yours. The greatest value of creating a Personal Balance Sheet is to collect all information about your assets and liabilities into one place. Doing so is an excellent “reality check” for those with assets and liabilities scattered among different financial institutions which are seldom brought into the same picture.

Using the sample chart below will give you a sense of whether your account is an asset or a liability.

For most families who own a home, net worth will be negative. Don’t get discouraged by this but instead look and work toward the time when your mortgage will be paid off. Of course, equity built in your home can go under the asset column.

I hope you’ll take time to go through this exercise. I have clients who are completely blown away when they have a true picture of their budget, net cash flow, and Personal Balance Sheet.

Next, in Part 3, we’ll cover how Steps 1 and 2 combine to help you develop your 401(k) investment plan.