Occasionally when I’m talking to someone about the importance of saving for retirement I’ll hear a comment like this: “Oh yeah, I’ve got my 401(k) all set up. I’m good to go!” While having a 401(k) is a good step, it’s only part of the retirement battle. Simply having a 401(k) is akin to having a gym membership--it gets you through the door, but you need to do something with it.

Let’s look at four families: the Thompsons, the Currys, the Greens and the Durants (I just made them up--honest!), to see how families with very similar financials circumstances can end up very differently when it comes to building 401(k) wealth. For simplicity, we’ll ignore any tax implications of these decisions.

The Value of Earning Your Full 401k Match

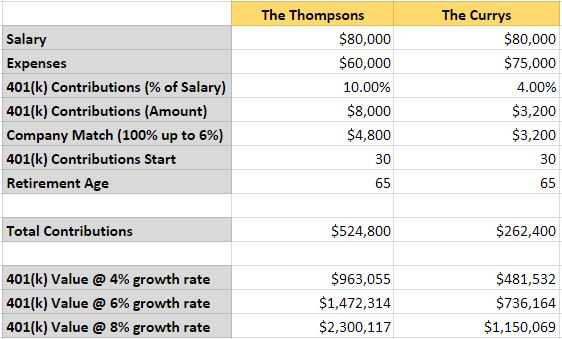

First we’ll look at the Thompsons and the Currys. Notice in the table below that these two families have an identical income situation with both earning $80,000 a year. However, the Curry’s expenses are a bit higher. Maybe they like to vacation more often or lease a new car every couple of years.

As a result, the Currys feel a little cash-strapped when it comes to contributing to their 401(k). Hard-pressed for money, the Currys only put 4.00% of their salary toward their 401(k) while the Thompsons contribute 10.00%.

There’s a big problem with what the Currys have done, which they may not realize until later in life when it’s too late. Their unwillingness to contribute at least 6.00% to earn the full company match has left money on the table which they cannot claim. Take a look at the total amounts contributed after 35 years.

Due to the Thompson's contribution rate of 10.00% and subsequently earning the full company match, their total contributions are double those of the Curry's. Assuming a variety of possible average growth rates, the Thompsons could potentially earn hundreds of thousands, if not millions of dollars more than the Currys!

The Value of Time in the Market for your 401k

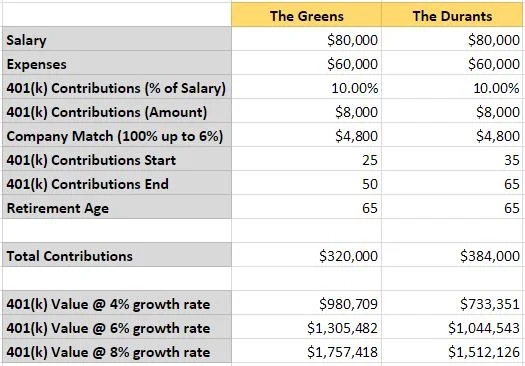

Now let’s consider a different situation with the Greens and the Durants. Both the Greens and the Durants have kept their expenses well below their salaries allowing them to both contribute 10.00% of their salary to their 401(k)s and earn the full company match.

But the Durants have delayed participating in their 401(k) until 10 years after the Greens began. The Durants, realizing their mistake, decide to contribute 10.00% plus their company match each year for 30 years to play catch-up.

The Greens wisely started at the age of 25, but a family crisis comes up which they will need a lot of extra money for. Their contributions completely stop at age 50.

It’s worth noting that the Durant’s contributions have exceeded the Greens' by $64,000. Interestingly, it makes little difference. The amount of time that the Greens have spent invested, despite contributing less in total and stopping at age 50, has pushed them well ahead of the Durants, again given our assumed average rates of return.

Keep these examples in mind the next time you think about patting yourself on the back for having a 401(k) and getting a bit of an employer match. It should be clear that having a 401(k) is the right start, but it needs to be managed well. While your 401(k)’s investment returns are largely out of your hands, there are still several things you can control:

Earn Your Full Company Match

This is free money that should never be left on the table. Your employer is offering you a big financial incentive to save--take them up on it!

Keep your living expenses in check

I would guess that most people aren’t earning their company match because their spending is too high, not because they don’t know any better.

Start saving early

I believe the amount of time an investor is in the market is a great financial “in-equalizer,” separating families that end up doing okay from those who do well.

Save consistently

Your family will probably fall on some hard times. The market may go haywire and you’ll want to stop contributing, or sell your investments altogether. It would have been harder for these four families to have experienced the success they did without consistently contributing through it all.