Life insurance isn’t the most thrilling topic, but there are many tragic stories of a family’s breadwinner passing away, with no life insurance in place to speak of. If you’re smart, you’ll do all you can to have at least some protection for you or your spouse, and perhaps both.

But what kind of life insurance is right for you? Knowing which type of life insurance to purchase usually starts with the discussion or two basic types of life insurance: term insurance and permanent insurance.

Term Insurance is Pure, Low-Cost Life Insurance

Term insurance, as I’ve discussed previously, is life insurance which only covers you for a certain period of time, say 25 years. If the term concludes and you’re still alive, the policy expires with no other benefits. Term insurance can be considered “pure insurance” because it provides a specific, unchanging death benefit within the term with no other benefits.

The appeal of term insurance is it’s low cost. Due to its lack of features relative to permanent insurance, the fees on term coverage are extremely low. The broad appeal of term coverage means competition is also strong, driving costs down further.

Proponents of term coverage have been known to advocate the “buy term and invest the difference” approach. This suggests buying enough term insurance for as long as you need it, such as when you retire at 65, and investing the amount you save (instead of purchasing a more expensive permanent insurance policy) in a high-interest savings account or the stock market.

A $500,000 amount of life insurance coverage with a term of 25 years may cost a 35 year old male $30-$50 in monthly premium payments depending on the insurer he chooses and his health history.

Term Life Insurance Pros:

Provides pure insurance coverage

Very low costs

- Insurance cost savings can be invested

Term Life Insurance Cons:

Insurance protection expires after period of time

No forced savings element like permanent insurance

Permanent Insurance is Insurance Protection Plus Cash Value

As opposed to term insurance which by definition has an expiration date, permanent insurance is just that--permanent. It stays with you your whole life. However, it’s not simply a never-ending “pure insurance” policy like term coverage.

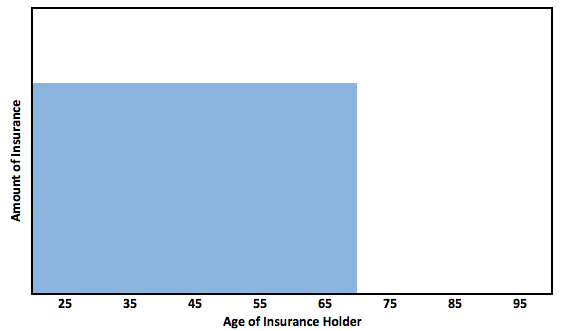

Permanent insurance has two components: insurance protection and cash value. These two elements work in tandem with each other over your entire life. As time passes and you make your premium payments, your policy gradually increases in cash value and decreases in insurance protection, as illustrated below.

In this way your growing cash value is essentially filling the role of the permanent insurance over time. The cash value in most policies can be withdrawn, borrowed against, or used as collateral for virtually any other sort of loan since it’s considered as good as cash.

The cash value can also be used for any number of your expenses once you pass away, such as funeral costs, buying a nice shiny casket, or leaving an inheritance for your children.

The appeal of permanent insurance is in addition to receiving some protection, you’re building up savings as well to be used in a variety of ways as mentioned above. This method of “forced savings” helps discipline some savers and provides a reserve of cash that can be drawn on or borrowed from for a variety of needs throughout your life or following your death.

Given the added features of permanent insurance, it is more expensive than term insurance. A $500,000 policy for a 35 year old male may cost $100-$150 in monthly premium payments, but it can significantly vary depending on the different features (known as riders) which accompany your policy.

Permanent Insurance Pros:

Builds cash value

Provides insurance protection

- Acts as an account for "forced savings"

Permanent Insurance Cons:

More expensive than term insurance

Cash value element may be unnecessary for some families

Which Type of Insurance Is Right for My Family?

Deciding on the right life insurance policy for you should start with a discussion between you and your spouse about your financial needs. Simply put, a life insurance policy-whether it’s term or permanent coverage--won’t make a huge difference if you pass away and your family isn’t taken care of financially for as long as they’d hoped.

Once you've made an assessment of your needs, the next step is to consider the different features of the two policy types and which ones make the most sense to you.

For instance, are you already a disciplined saver with some emergency savings and a 401(k) you’re actively contributing to? Do you anticipate being able to cover your funeral expenses if you passed away without life insurance? If so, term life insurance coverage will likely be sufficient.

On the other hand, perhaps you’re the kind of person who tends to put off future financial needs, particularly those which don’t seem imminent. Term coverage makes sense to many families, but since there is nothing left when your coverage expires you’re family will be left handling your funeral and other expenses if you die after your policy expires. In this case, the “forced savings” feature of permanent life insurance may be appropriate.

Make the Insurance Choice That Best Fits Your Needs

I hope this article has been helpful. In most cases I recommend young families purchase term insurance and “invest the difference” by utilizing tools like automated savings and investment accounts. However, there are a wide variety of circumstances where purchasing permanent insurance makes a lot of sense.

The most important thing is to first, understand what your family’s future financial needs could be, and second, decide whether you’re disciplined enough to save for future needs on your own or whether a “forced savings” feature gives you the best chances for taking care of your family.

What has your experience been purchasing insurance? Are you a "term" or "permanent" family? Do you have other questions about these different types of coverage? Leave a question or comment below!