I love 401(k) plans! Sure they’re not perfect, but few tools are better equipped to help families build wealth for a comfortable retirement.

But there are some common 401(k) pitfalls that can really get folks in trouble. In many cases, these 401(k) mistakes can end up costing investors tens or hundreds of thousands of dollars over a career of diligent saving!

Here are 4 common 401(k) dangers, and how to avoid them.

1. High 401(k) Fees

Fees are the silent killer of 401(k) plans. There are a variety of fees in 401(k) plans, but the most common perpetrator are the fees tied to your individual investments.

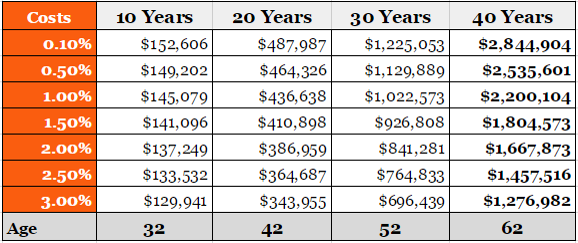

These fees, called expense ratios, apply to every mutual fund investment in your 401(k). They typically range from 0.10% to 2.00%. So if you have $10,000 invested in a mutual fund with an expense ratio of 2%, your annual fee would be $200.

A 2.00% fee may not seem like a big deal, but it can make a HUGE impact over your 40 year career. Take a look at this chart as an illustration and note the difference between an investor's portfolio value after 40 years (last column) impacted by a 0.50% fee versus a 2.00% fee.

Source: http://www.physicianonfire.com/investment-fees-will-cost-millions/

I suggest families find low-cost funds for their 401(k) portfolios when available and assuming the investments are well diversified, and align with your goals and risk tolerance. The impact over time can be tremendous!

2. Borrowing from Your 401(k)

Did you know you can borrow money from your 401(k) in certain cases--such as for a home purchase--without penalty? While this strategy may seem appealing, it can cause problems.

The biggest issue I see, is the missed opportunity to continue building your wealth for retirement. Any money outside your 401(k) isn’t going toward most families’ #1 financial goal: a comfortable retirement.

Generally, families should avoid the complexity and dangers that come with borrowing from their 401(k). Don’t treat your 401(k) like a piggy bank to pull money out of every so often, or as a loan to finance other purchases. Use it for tax-advantaged savings toward your financial independence.

3. Not Keeping Track of Your Old 401(k) Plans

According to the Bureau of Labor Statistics, people born towards the end of the baby boom held an average of 11 different jobs over their career. Even if you hold only half that many, that’s a lot of job hopping and a lot of new 401(k) plans!

With many employers offering 401(k) plans to their employees, there’s a big chance for old 401(k) plans to go completely forgotten and their investments to fall out of whack at the same time.

If this sounds like you, take some time to look through your old records or contact your previous employers’ HR departments. If you find an old 401(k) or two you can typically roll them over into a Rollover IRA, allowing you to better track your investments and your wealth.

4. Not Taking Your Required Minimum 401(k) Distributions (RMDs)

Eventually for pre-tax 401(k) savers, the time comes for Uncle Sam to collect his just desserts: taxes. The IRS makes sure this happens through required minimum distributions, (RMDs) or an amount of money you need to take from your 401(k) each year once you reach age 70 1/2.

The danger is in taking less than the required minimum, or not taking a distribution at all. If this happens, the IRS can take, as a penalty, an added 50% tax on the amount not distributed!

If you’re approaching retirement, make sure you know how much you’ll be required to take from your 401(k) when the times comes. Families should pay their fair share to Uncle Sam, but nothing more.

If any of these trouble areas apply to your financial situation or your 401(k), now is the time to get them resolved. Spend a little time this week reviewing your 401(k) account (and perhaps tracking down some old ones). Your future, retired self will thank you.

I recently published a free eBook, The 401(k) Workshop. It’s a step-by-step process for increasing the wealth building potential of your 401(k). If you enjoyed this article, I think you’ll find the eBook helpful. You can download it for free right here.