We could all use some extra cash, but the idea of working more for it isn’t always fun, or even possible. As I’ve handled my own finances over the years and helped others with theirs, I’ve spotted some common ways to find more money--a lot of money actually. I’d love to share with you what I’ve learned.

Remember that discovering “new” money is done in two ways: money we don’t need to spend (expenses), and money we can be earning (income). I’ll cover both in this article, since the answer isn’t always to cut, cut, cut expenses. I’ve also estimated a range for what most households could save. If you have a higher income, you can generally be saving more, since you’re probably spending more, too.

Not all of these methods will apply to you, but I believe they apply to most families. I hope you’ll find them useful and have a smart plan for where to put your extra savings each month once you’ve found it!

CUTTING EXPENSES

When it comes to finding some extra cash, most people look at cutting expenses first. Most of us know our spending could be less than it is right now. You remember the early days of being in college or a newlywed when money was tighter, right? Somehow you managed to stay alive and stay happy.

Here are the main areas where I’ve found unnecessary spending to be hiding.

Reduce Your monthly “fluff” spending

It’s the spending category I cleverly call “Miscellaneous” in my personal budget so I don’t feel bad about it! It’s the “Shopping”, “Dining Out”, “Clothes”, and “Entertainment” categories where we’re usually spending extra money that makes us feel good for a short while, but over time doesn’t help us much.

Lots of "Miscellaneous" spending going on here.

If you don’t keep a budget--start there. You’ll never know how much “fluff” spending is going on until you start tracking it. Once you’ve started your budget, track how much is going to these non-essential spending areas. You’ll probably be surprised. I’m not suggesting you eliminate all of this spending. Heaven knows I’ve gotta have a fast food and movie theatre fix once in a while. But most households can easily shave off $150 per month.

Estimated savings: $150-$500 per month

Change Your life insurance policy

Life insurance is extremely important to have, especially if you have a family dependent on your income. But not every life insurance policy is a good deal. There may be some overly expensive life insurance policies which might cause you to sacrifice other financial investments, like contributing enough to your 401k.

If you’re stuck with a bad life insurance policy, you have options. Besides surrendering your policy, you can decrease your premium payments or convert your policy to something simpler that may better fit your needs. As life insurance policies increase in complexity, their fees tend to increase as well. A simpler policy could be better suited for you and potentially save you hundreds of dollars a month as well.

Estimated savings: $75-$500 per month

Increase your auto insurance deductibles

Your auto insurance is paid monthly, semi-annually or annually through your premium payment. Your premium is impacted by several things, one of which is how high or low your deductible is. Lower deductibles result in higher premiums, while higher deductibles result in lower premiums.

Raising your collision deductible could save a decent chunk of money each month. According to a recent study consumers across the U.S. can save the following amounts by raising their car insurance deductibles:

- 7 percent if you increase your deductible from $250 to $500

- 9 percent if you raise your deductible from $500 to $1,000

- 16 percent by hiking your deductible from $500 to $2,000

(Tip: For extra savings you can often pay your premium for the whole year and receive a discount. If you’ve got the cash it may be worth it!)

Estimated savings: $10-$40 per month

INCREASING INCOME

Cutting expenses is all well and fine, but most of us groan and writhe when cuts are needed, especially when it’s cutting out the things we love. While a close look at your expenses is often warranted, finding extra money is just as much a factor as reducing spending.

The trick is to not spend more time earning that extra money. Here are a few ways to increase your earnings without picking up a night job or a side hustle.

Adjust your tax withholdings

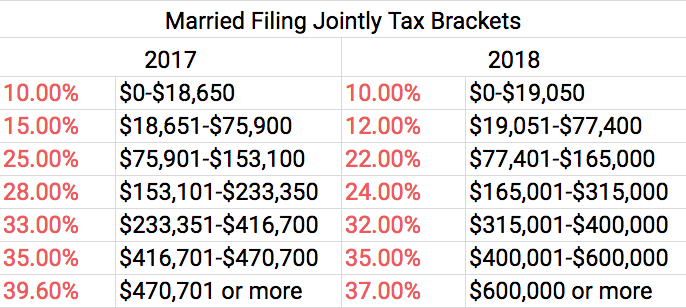

The new tax laws which passed late last year are likely to add some extra cash to just about everyone’s paychecks. For many families the tax brackets were reduced anywhere from 2 to 4%. Rather than waiting to collect that extra money when you file your taxes next year, make a plan for it now.

I used to be like others who prefer receiving that nice chunk of tax refund money around March or April, but the fact remains that this is a interest-free loan you’re making to the federal government. Instead of giving them free access to what’s yours, I’d encourage you to keep it and invest it. This could be an “investment” in paying down credit card or student debt, or putting more into your 401k or IRA (which could provide yet another tax break!)

“For many families the tax brackets were reduced anywhere from 2 to 4%!”

You can talk to your CPA or go to IRS.gov to learn how to adjust your W-4 withholding. Depending on what your refund typically looks like, this could be a significant savings.

Estimated savings: $50-$1,000 per month

Find a good credit card rewards program

If you are disciplined with your credit card debt, meaning you pay off your credit card each month, then you should look into a credit card with good rewards. Cash rewards are always great, but if you’re an airline miles kind of person and you like to travel frequently, then go for it.

For those wanting to use credit card points for extra cash, I’ve been really happy with Fidelity’s Visa Rewards card. They pay 2% into your Fidelity Investment account for every purchase made. So if you charge $1,000 to your card each month, you earn an extra $20. Kellie and I have loved using this card as a “savings account” for our holiday spending, but there’s no reason you couldn’t cash in your points each month.

(Tip: Fidelity requires you to have an investment account to direct your cash rewards to. You can either invest it or transfer the money to a different bank.)

Estimated savings: $10-$50 per month

Use a High yield savings accounts

I’m at the point in my business where I encourage any client with emergency funds to move it to a high-yield savings account, such as with Ally Bank. These accounts tend to pay a much higher interest rate than a checking or savings account at your local bank, and they still carry FDIC insurance protection. Ally is currently paying 1.45% per year.

Do the math on that. If you have a healthy emergency fund of $15,000 you could earn an extra $217 per year or $18 per month. This is far and above what your checking account is paying, I assure you!

Estimated savings: $5-$50 per month

Now that you’ve possibly saved as much as $2,000 per month or more, I hope you’ll take this savings and direct it towards something meaningful. This may be paying off debt, saving for retirement, or your kid’s college. Or even an awesome vacation next year. It’s up to you.

The important thing is to spend your money on things that hold lasting value and can really make you happy. I hope this exercise has helped you find a little more cash to do so.