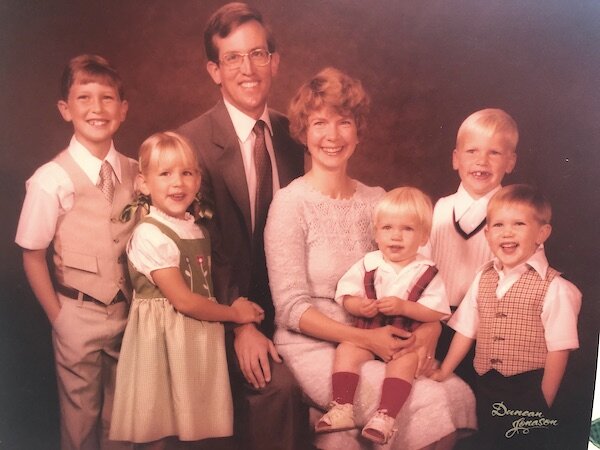

I’ve benefited from the steady counsel (and steady lap!) of my mom over the years.

After a recent conversation with my mom I commented to my wife, “I just love my chats with mom. When I finish talking to her I feel so grounded.” I know I’m not alone. Moms can bring a calming, stable influence into our turbulent lives.

We all need this stability and grounding--emotionally and financially--especially when we’re feeling the wide swings. During a seminar I gave this week, I talked about a financial tool that can bring stability to our financial lives. While bond investments may be seen as the boring aspect of our investment portfolios, their role is crucial, especially when our investment portfolios are in need of some “grounding” of their own.

Two fundamental building blocks of any investment portfolio are stocks and bonds, typically held in a mutual fund or ETF. They serve distinct roles. Portfolio growth comes from stocks. Stocks reflect your literal ownership in businesses--with some businesses growing and others failing. This potential for growth and loss brings risk, which is why we may see the stock market climb nearly 30% in 2019, or see it drop significantly in a month or two.

The stock market has performed well over the last 14 years, but those dips make many nauseous.

Bonds play a very different role. They’re the “mom” of your investment portfolio. Not bringing complete safety but relative stability to an otherwise wild rollercoaster. Things got pretty wild growing up with my four brothers and four sisters. Mom, choosing to stay at home while my dad worked, was an essential part of the mix. I’m pretty sure that without her a few of us would be dead by now. Mom was the “bond” of an otherwise all “stock” portfolio.

That “mix” in my family is the same thing that needs to happen in just about every investment portfolio. The wild swings of stocks can be paired with the relative stability of bonds. Furthermore, when stock prices drop, bond prices actually tend to increase, creating a partial offsetting effect on our portfolios overall. Currently, the S&P 500 Index is down over 10% for the year, while bonds (as measured by the Vanguard Total Bond Market Index) are actually up over 3%. Stability AND risk are essential.

Let me illustrate this another way by describing two sample investment portfolios below. The portfolio on the left is what I consider very aggressive. 90% of the portfolio is in equities (stocks), while only about 10% is in bonds. As a result, the average annual return is quite high--8.4%. Also note the 14.1% standard deviation, which measures the “ups and downs” of this portfolio. We’ll come back to that number in a moment.

The portfolio on the right shows a more balanced portfolio with 50% in equities, and 40% in bonds and another 10% in cash. The average annual return is quite lower--6.3%. But note the standard deviation. At 8.8%, it’s significantly lower than the first portfolio. The larger share of bonds in this portfolio has decreased the overall expected returns, but it has also lessened the ups and downs.

Click the image to expand

I cannot tell you how many conversations I’ve had with individuals concerned about the losses the stock market occasionally suffers. In some cases, this has kept them from any sort of investing whatsoever. What they miss (and what I try to teach them) is that investing doesn’t have to be a binary decision. The choice never has to be “put all your money into stocks or else do nothing.” Rather, investing is about finding a harmonized balance between stocks and bonds, beginning with figuring out what you, the investor, are most comfortable with. “How much you want to feel grounded?” is the question at hand.

So please respect the crucial role bonds play in your portfolio. They’ve been shown over time to cause a stabilizing effect to our portfolios, a “stability” we could maybe use a little more of.