Photo by Max Harlynking on Unsplash

A Wall Street Journal article caught our attention recently. The headline read “You Don’t Need to Be A Millionaire to Retire.” Hale Financial has enough non-millionaire retired clients that we know this to be true, but the article explained that of a group of retirees surveyed who had less than $100,000; over 70% of them said they were doing fine financially.

“Ok, what’s the catch?” There are some catches to living a retired life with less than $100,000, but after analyzing what we’ve learned working with many Wyoming retirees, we’ve found that it is possible, with certain limitations.

Today’s article is to review some of our findings and provide some insights into how Wyoming families can also retire comfortably while having FAR less than a million dollars.

Meet Scott and Kathryn Anybody

To help me figure this out, we used financial planning software to create a fictitious retired couple named Scott and Kathryn Anybody. Here are some of their attributes:

Scott is age 65, Kathryn is age 65

Scott worked 40 years as a utility lineman; Kathryn was a homemaker

Both Scott and Kathryn are retired; both have started Social Security

Scott receives Social Security of $3,000/mo; Kathyrn receives the spousal benefit of $1,500/mo

They are completely debt free

Their main assets include their home, valued at $400,000, two cars, and $100,000 invested in a Roth IRA

Their household spending matches the national average for a retired couple which is $54,000

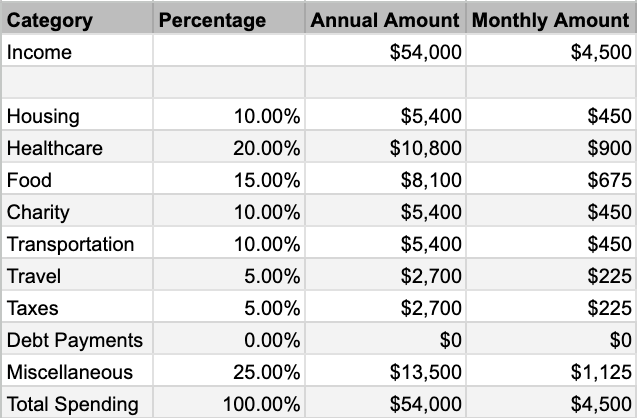

So how are the Anybodys doing? You can review the table below to see how much they’re spending annually and monthly across different categories.

You can see from this chart that the Anybodys aren’t doing too bad on $54k a year. Let’s breakdown some of the details of how the Anybodys are living to see how well they’re getting by.

HOUSING

The Anybody’s housing costs are modest since their mortgage is paid off. Their spending assumes $4,000 per year that is allocated to a savings “bucket” for future home maintenance costs. They also pay $1,400 for homeowner’s insurance.

HEALTHCARE

The Anybody’s healthcare spending covers their Medicare premiums, deductibles and out of pocket expenses. This annual spending amount is close to the national average of $12,000 per year for a retired couple. If they’re not in great health, they may need to allocate more spending to this category.

FOOD

15% of the Anybody’s income going to food translates to $675 per month, which is an ample sum for most two-person households. [Editor’s Note: I have a family of five and our grocery bill averages around $800 per month.] This amount does not include food for restaurants, but only groceries.

TAXES

The Anybody’s pay about 5% of their annual income to property taxes, and they pay no federal income taxes. Let’s repeat that: The Anybodys pay no federal income taxes. Since their income is made up entirely of modest Social Security payments, they fall within the 0% taxable limit for Social Security income, and subsequently owe no federal income taxes on these payments. The Anybodys don’t even need to file an annual tax return! There are no state income taxes in Wyoming to worry about either.

OTHER SPENDING

The Anybody’s Travel and Miscellaneous categories make up their remaining spending. It’s a hefty sum at a combined $16,200 per year, which gives them $1,350 per month to spend on utilities, Burger King, entertainment, shopping, and travel to not-too-exotic locations. A lot of these expenses are discretionary, making them easier to reduce if funds ever get tight.

Headwinds: Threats to a “Social Security-Only” Retirement

Long-term care

A long-term care situation can be financially catastrophic to many families. The extent of long-term care services needed can vary widely, but whether your care is received at home several days a week from a qualified nurse, or as a resident of a full-service care facility, the monthly bill can cost in excess of $8,000 per month.

This would quickly drain the Anybody’s $100,000 in Roth IRA funds. Then what? Are they kicked out of the care facility? No, this is where Medicaid can possibly kick in. In the government’s eyes, the Anybodys could be viewed as “too poor” to afford this care, so Medicaid may step in for them. Medicaid rules are complex and differ state by state, so it’s worth taking the time to understand each state’s requirements. Generally in Wyoming, the Anybody’s would be eligible for Medicaid assistance once their Roth IRA was depleted, and they would not have to sell their home to receive it.

Major home repair

What if the Anybodys experience the need for a major home repair, like a new roof? How can an upgrade like this, costing tens of thousands of dollars, be covered? This is where their Roth IRA funds can come in.

As an alternative, many homeowners turn to a home equity line of credit, or HELOC, to cover these expenses, but if the Anybodys resort to this then they now have debt! The Anybodys are rightfully averse to debt in retirement, but we’ve at least shown there is wiggle room in their budget, so perhaps they pull $20k from their Roth IRA for a new roof, finance the rest, and use budgeted funds to payoff the loan balance.

Another option would be to address any major repairs like this before retirement. These are hard to anticipate, but following a home maintenance schedule could help the Anybodys address some items before retirement.

Death

If Scott passes away, Scott’s Social Security benefit now becomes Kathryn’s benefit. There is only one of them, but income is still reduced by ⅓ and certain expenses, like home maintenance and property taxes, cost the same whether there are one or two people in the home. This could put a strain on Kathryn’s finances, but it certainly wouldn’t be an impossible living situation.

KEY POINTS

Get as much from Social Security as you can

To pull off this plan, the Anybodys needed to work until age 65, which is longer than some Americans are comfortable with. If they had started Social Security as early as possible (age 62), Scott’s SS benefit would have been reduced significantly, and in turn, so would Kathyrn’s. Some retirees are able to retire from work earlier and delay starting Social Security by “bridging the income gap” using retirement withdrawals, but this would have quickly depleted the Anybodys Roth IRA funds.

While the Anybodys are receiving a good Social Security benefit, notice that they didn’t max it out. To do this, Scott would have needed to wait until age 70. It’s important to get as much as you can from Social Security and our general advice at Hale Financial is to maximize the benefit of the highest earner, but this clearly wasn’t essential for the Anybodys. They are living comfortably without it.

Get debt-free

This point cannot be emphasized enough. The Anybodys retired with no debt. Zero, zilch. No car payment, no mortgage, no camper or side-by-side ATV. It doesn’t mean they don’t own any of these things (our assumptions are that they at least own a home and a car), but they simply didn’t carry any payments for these items into retirement.

I’m not going to turn this post into a Dave Ramsey-esque, destroy your credit cards and “get debt free!” sermon, but this article should emphasize just how little income retirees need when they aren’t burdened by debt payments. Consider the cash flow situation the Anybodys would be in if they had a $600/month car payment and a $900/month mortgage payment. Their finances blow up, and they’re left to either go back to work, or find some way to go back in time and build a larger nest egg.

Be realistic about spending

The Anybodys aren’t living high on the hog, but they clearly aren’t living a highly frugal lifestyle. By most of the developed world’s standards, they live very comfortably. Their income was likely considerably higher before they retired, but so was their spending on fuel to get to work, kid-related expenses, retirement savings, employment and income taxes, and paying off debts before retirement. Research shows that post-retirement spending is often considerably less than pre-retirement spending, to the tune of 20% to 40%, or higher.

We think this reader comment from the Wall Street Journal article cited above illustrates the point well:

My wife and I live mostly on our social security and do well. We retired early 20+ years ago on advice from a financial advisor that it was possible to live comfortably with social security eventually becoming our main source of income for day to day living and small IRA funds for a backup. His advice was that as long as we were not planning to travel the world every year our modest IRA's would carry us comfortably and so far it has worked. We don't buy new vehicles and live in our same home of 40+ years, enjoy our family and friends, dine out quite a bit (which has become way more expensive since Covid), travel mostly within the USA occasionally and live within our means by paying off credit card charges every month in full. It is not a glamorous lifestyle in a 55+ community as seen on tv but it is the lifestyle we chose years ago with the realization that as we age our daily lives become more about health, home, faith and family and less about what we have or don't have in order to be content according to experts!

We hope you’ve enjoyed this article. Our fact-checking into whether a Wyoming family can live only on Social Security shows that this argument holds up fairly well to scrutiny. Our fictitious family, the Anybodys, aren’t millionaires, but having retired with strong Social Security payments, no debt, and a reasonable budget, plus a $100,000 investment cushion, has put them in a pretty good position. Financial headwinds exist, however, so the Anybodys will need to be vigilant in watching their finances during their retirement years.