Photo by Dawid Tkocz on Unsplash

The Greek philosopher Heraclitus is credited with saying “everything changes and nothing remains still.” He argued that this saying captures the essence of the entire universe. I’m not sure if he’s right or wrong, but it certainly gets close to capturing the essence of economic events across the world.

Are there lessons to be learned from world economic events and how they impact financial markets, particularly stocks? I’d like to explore this idea briefly today, and I promise it won’t get too deep or nerdy. In fact, by the time I’m done you may have some added perspective to help you navigate the uncertain times we’ve always been in, and will continue to experience.

I’ve been wondering: What are the top economic events the world has experienced over the last five years? My ol’ buddy ChatGPT helped me out with this one. Here’s what it sent me (in chronological order):

U.S.-China Trade War (2018-2020)

COVID-19 Pandemic and Economic Impact (2020-2022)

Global Energy Crisis (2021-2022)

Russia-Ukraine Conflict (2022-Present)

Global Inflation Surge (2021-2023)

Interest Rate Hikes by Major Central Banks (2022-2023)

Banking Crisis and Financial Sector Stress (2023)

Technology Sector Challenges (2022-2024)

Green Transition and Climate Policies (2019-2024)

Some of these events may still put a sour taste in your mouth, and some of them you may have never heard of, but all of them have posed serious economic threats to the US and world economies. (One glaring omission from ChatGPT’s list is the current Israel-Gaza conflict.)

Items 5 and 6, the Global Inflation Surge and Interest Rate Hikes by Major Central Banks, hit particularly close to the financial pocket books of American families. At its peak, inflation hit 9.1% in June 2022, pushing consumer goods prices through the roof and leading to soaring interest rates.

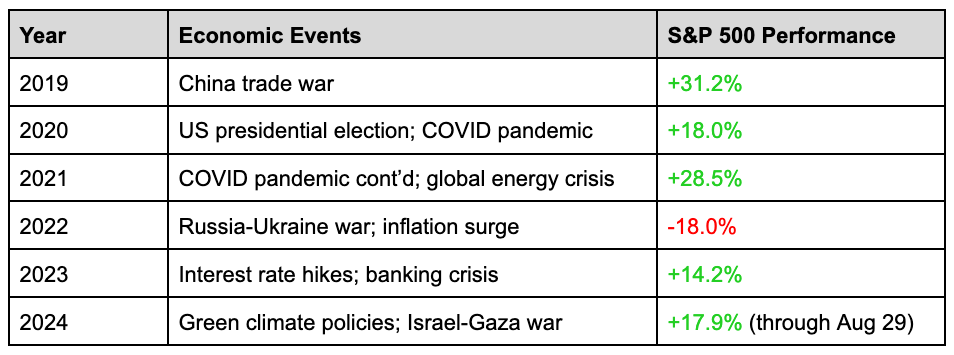

What was the stock market doing during this same 5-year period? Despite a continued trade war with China in 2019 the stock market performed very well, with the S&P 500 gaining 31%. As the COVID-19 pandemic came on, markets dropped significantly in late 2020 only to fully recover and then some by the end of that same year.

Stimulus spending following COVID kept the market cranking in 2021, but by 2022 our spending caught up to us, leading to a major surge in inflation. The stock market dropped 18%.

As the Federal Reserve slowly started regaining control of inflation, the market rallied once again in 2023, and with continued hopes of a “soft” economic landing following record inflation, the stock market continues to do well in 2024.

In summary, the S&P 500 has nearly doubled, up 91% from 5 years ago.

These aren’t guaranteed returns of course. The stock market has experienced plenty of losses over its history. In fact, since the 1920’s, 12% of the stock market’s 5-year periods have experienced losses, and there have been several years, like in the early 2000’s, when the stock market lost significant value year after year. Below is a table showing these gains and losses over time (click to enlarge).

Content Source: https://awealthofcommonsense.com/2023/06/u-s-stock-market-gains-losses-by-the-numbers/

But we have to ask ourselves: With so much economic uncertainty–and even downright despair–over the last five years, how has the stock market experienced such strong returns?

Entire books get written attempting to answer this question, and I promised to not nerd-out too much on this post, but shouldn’t we at least consider that world economic events and stock market performance are not in a perfectly correlated relationship, or in other words, that it’s possible to have economic upheaval AND financial prosperity over time? The last five years seems to suggest so, as do the last 100 years.

The dastardly hard part with all of this, where things get most uncomfortable, is the same thing never happens twice. The particular economic uncertainties of the last five years in no way reflected the uncertainties of the previous five, or the previous fifty.

Indeed, as Heraclitus also aptly wrote, “You cannot step twice in the same stream.” Everything changes and nothing remains still.

What do the next five years look like? Will our relationship with China continue to sour? Will we be at war? Will a major virus once again imperil humanity? Will Taylor Swift and Travis Kelce become the benevolent dictators of the world?

I don’t know the answer to any of these questions. But a look back at history has at least shown that the stock market has found a way to prosper through the world’s challenges.

Will this continue? I’m hopefully optimistic that it will, but perhaps only Heraclitus knows for sure (probably not).