Welcome to 401(k) Workshop, Part 4: How to Choose the Right Investments for You.

Your 401(k) is an incredibly powerful tool to help you build wealth, but it’s not perfect. Many people have expressed confusion and frustration with how to choose their investments, how much money they need in their 401(k), and an array of other issues. In addition, there are probably some unknown elements of your 401(k) that are working against your financial success!

This series provides a step-by-step process for evaluating your 401(k)’s purpose (it’s about more than just “save up a bunch of money”), understanding how your current financial situation affects your 401(k)'s future growth, and developing a plan for getting the most out of your 401(k) to better provide for your financial future.

401(k) Investing Isn't Stock Picking

Picking investments in your 401(k) is a lot different than picking stocks. Thank goodness. Most people, myself included, are terrible stock pickers. Fortunately, few 401(k)s allow you to pick individual stocks. When we talk about choosing 401(k) investments, we’re talking about choosing mutual funds.

Mutual funds can hold millions of stock shares or bonds from thousands of different companies. Investing in a mutual fund allows you to buy shares of the fund, which is like purchasing small slices of each of the many individual investments within the fund. This subjects your 401(k) to substantially less risk as opposed to investing in a few individual stocks.

This is called diversification, and it’s the shining attribute of mutual funds.

WHAT IS YOUR RISK APPETITE?

Before choosing your investments, it’s essential to understand your willingness to accept investment risk. Let me provide some context to “risk appetite” with this question:

If the value of your 401(k) dropped 30% in one year, what would you do?

- Freak out and sell everything to save any money you have left

- Hide in your basement in the fetal position and wait out the chaos

- Invest more, taking advantage of lower investment prices

It’s important to know that a 30% drop in the stock market will affect some 401(k) investments more severely than others.

Take the 2008 financial crisis as an example. During this period, the stock market dropped around 30-40% in 2008 alone. From January to March 2009, it lost another 20% or so. That’s roughly 50-60% of its value! However, the bond market actually gained a few percentage points over this same period.

If you cannot stomach significant short-term losses, you may be better off choosing at least some 401(k) investments with less risk, such as bonds, in order to help level out the ups and downs.

INVESTMENT RISK AND RETURN

Since low-risk investments are available in 401(k)s, why not put all of your money into low-risk investments to keep your money safer? The principal of risk/return dictates that less risky investments, like bonds, must return a lower rate of return than more risky investments such as stocks.

An all bond portfolio has historically returned around 3% per year, while an all stock portfolio has returned closer to 8-10% (after inflation and including dividends). If you’re interested in having your 401(k) grow enough to provide for 20-30 years of retirement, either some risky investments will be required or the amount you're saving will need to significantly increase.

MUTUAL FUND CLASSES WITHIN YOUR 401(K)

Your 401(k) will likely have a wide variety of more risky to less risky mutual funds to choose from. Most 401(k)s I’ve seen have around 15 to 30 choices. These investments can generally be categorized and defined by the following fund classes:

Money Market Funds

The primary investment of this fund is cash and cash equivalents, like certificates of deposit (CDs) and commercial paper.

U.S. Bonds or Fixed Income Funds

These mutual funds invest in a wide range of fixed-income investments such as bills, notes, and bonds, all within the U.S., and are issued by the U.S. government, municipalities, or U.S.-based corporations. Some of these bonds may be high quality while others may be lower quality.

International Bond Funds

Same as the previous, except these mutual funds invest in bonds issued by the governments of or businesses in foreign countries. These tend to be developed foreign countries, rather than emerging market countries (see below).

Blended Funds

These mutual funds invest in a combination of stocks and bonds, providing greater potential for long-term growth (stocks) as well as income generation and safety of your principal (bonds).

Large Cap U.S. Stock Funds

A stock mutual fund primarily investing in large cap U.S. companies (defined as a company with a market capitalization of over $5 billion).

Mid Cap U.S. Stock Funds

A stock mutual fund primarily investing in mid cap U.S. companies (defined as a company with a market capitalization between $2 to $5 billion). Mid cap companies tend to have more volatility (ups and downs) than large cap companies.

Small Cap U.S. Stock Funds

A stock mutual fund primarily investing in small cap U.S. companies (defined as a company with a market capitalization of over $300 million to $2 billion). Small cap companies tend to have more volatility than both mid cap and large cap companies.

International Stock Funds

A stock mutual fund focused on investments in foreign companies, typically in developed countries such as Germany or Japan.

Emerging Markets Stock Funds

A stock mutual fund focused on investments in foreign companies, typically in “emerging” countries where economic, political, or monetary systems are still developing.

*-- Target Date Funds --*

Also known as a lifecycle fund, these are mutual funds designed to automatically move from more risky investments to less risky investments over time, based on a predefined date of retirement.

The mutual funds described above generally move from less risky to more risky investments, with target date funds taken aside, since their risk level varies depending on the target date.

For example, emerging market funds are very high on the risk scale, relative to other funds. Money market funds primarily invest in relatively safe, short-term investments, placing them very low on the risk scale.

WHEN IN DOUBT, CHOOSE A TARGET DATE FUND

If you don’t want to make your own 401(k) choices, I would suggest choosing a target date fund if they are available.

These funds invest in a variety of mutual funds based on how far away you are from retirement. If retirement is 35 years away the investments will generally be more risky. As retirement gets closer, the investments in the fund shift towards less risky ones, since you’ll have less time to recover if the stock market takes a hit.

More and more 401(k)s are providing access to target date funds, which is a great thing. These funds can take a lot of the pressure off of making your own investment decisions for retirement.

One of the downsides of target date funds is they assume you have a certain tolerance for risk strictly based on your retirement age. For example, a mutual fund company may have a 2050 Retirement Fund (used by investors planning to retire around 2050) with an allocation of 90% stocks and 10% bonds.

This is generally a good approach to getting the growth you’ll need for retirement over 30-35 years, but a drop in the stock market of 30-40% may leave you reeling. Target date funds aren't great at taking your risk appetite into account. They basically say, “This is how much investment risk you should take if you want to retire at age X” regardless of the market ups and downs.

CHOOSING YOUR OWN 401K INVESTMENTS

If you do not have access to target date funds or if you prefer to make your own investment choices, I suggest starting with a retirement planning tool from your 401(k) provider’s website.

Many retirement planning tools allow you to enter your current age and the age you’d like to be upon retirement. You then answer some questions to identify your willingness to accept investment risk. The tool will then display a recommended portfolio based on these and other factors.

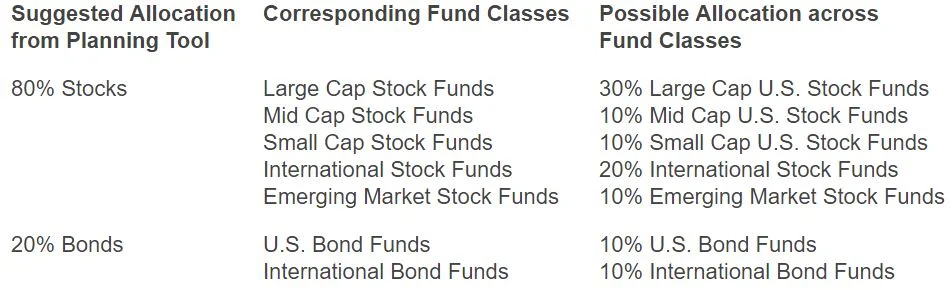

If your 401(k) provider doesn’t have a resource like this, I’d suggest using one from another large investment company. This one from Vanguard could be a good start. It asks questions about your financial goals and assesses your willingness to accept investment risk. The result is a suggested investment allocation based on your answers. For instance, when I completed the exercise, it suggested an allocation of 80% stocks and 20% bonds.

Unfortunately, the tool doesn’t give you a detailed breakdown of which asset classes may be right for you. What it does do is help provide an investment allocation based on your retirement plans AND risk appetite.

From there, it’s a matter of reviewing the available asset classes in your 401(k) and selecting which funds will go into your portfolio.

Research suggests that a globally diversified, low-cost portfolio may perform better over the long-term. Depending on the investments available in your 401(k), you may benefit from exposure to various stock and bond fund asset classes.

For example, suppose the Vanguard Investment Planning tool suggested an allocation of 80% stocks and 20% bonds. Depending on the fund classes available in your 401(k), you could construct your portfolio in this way:

This is just one of an endless variety of options. The important things to remember are to:

- Select investments based on your risk appetite

- Select investments based on how much you need your money to grow

- Understand that in order for your money to grow significantly over time, you’ll need to accept some risk

WATCH OUT FOR INVESTMENT FEES

Fees are the silent killer of many 401(k) plans, potentially eating away tens or even hundreds of thousands of dollars of earnings over the course of your career. The biggest villain among the different fees, and which you have at least some control over, is the expense ratio. This ratio can be found in the prospectus of your mutual fund, and typically ranges from .05% to 2.00%.

My general advice is to avoid mutual funds which have an expense ratio above 1.00%, and preferably closer to .50% or lower. While some mutual funds seek to outperform the market, this has historically been very difficult to do over long periods of time and increases the expense ratio.

If low-cost, index funds--which simply try to "match" the market rather than beat it--are available, you should strongly consider going with the lower-cost fund, as long as your risk appetite and need for investment growth are not compromised in the process.

BAKING COOKIES AND CHOOSING INVESTMENTS

I’m not a man of many talents, but I make a mean batch of chocolate chip oatmeal cookies. I love baking them on a chilly Sunday afternoon (we have many in Wyoming), filling the house with the wonderful aroma of warm butter, brown sugar, and oats.

One time while baking cookies, I accidentally left out some flour. I realized this when they came out of the oven looking much flatter than usual. I thought they were ruined. But they still tasted great! With baking cookies, you just need to get the essentials mostly right to still have a delicious cookie. Leave out the stuff you simply cannot put up with, like walnuts if someone has a nut allergy. And of course, remember to leave them in the oven long enough!

Baking cookies is similar to choosing investments. Some people think there is a lot of precision to the process, but I don't feel there needs to be.

First, make sure you get the essentials right: a well-diversified, relatively low-cost portfolio of stocks and bonds.

Second, leave out the things you can’t live with. If you absolutely cannot stomach wide swings in the market, you may want to favor more bond-type mutual funds rather than be 100% in stock mutual funds.

Finally, make sure you have enough “time in the market” so your portfolio can take advantage of the benefits of compounding interest.