Retirement is a steep cliff for many.

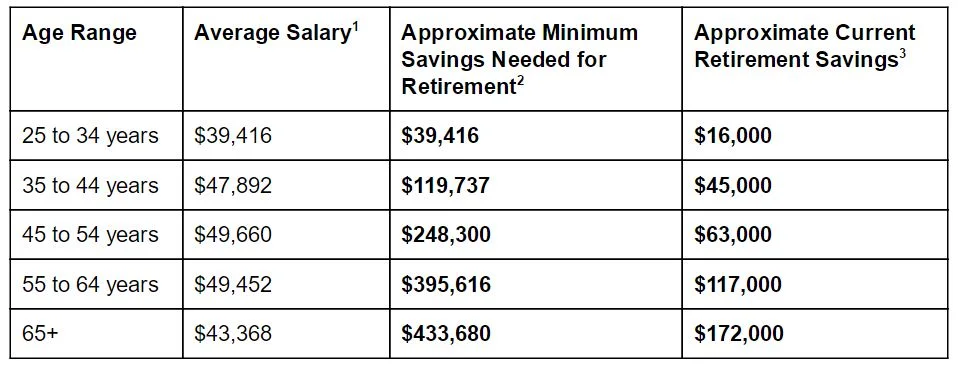

America is in the midst of a retirement crisis. Don’t believe me? Here’s the data:

There’s one element on the chart that could use a little clarification.

Fidelity suggests that savings at each age range needs to be a particular multiple of one’s salary. For instance, by the time you’re 35 you should have 2 times your salary in savings. By age 65, you should have at least 10 times your salary (I’ve previously suggested that it should be closer to 25 times). Each multiple times the amount in the 2nd column is the amount shown in 3rd column.

Compare the 3rd and 4th columns. See the problem? Americans are falling way behind on their retirement savings.

As I discuss this issue with others, I usually hear a couple of proposed solutions to this crisis:

Social Security will provide my retirement income

Social Security will certainly provide some income, but it was never meant to completely replace income lost at retirement. It’s designed to supplement it. Also note that Social Security is a regressive system, meaning that those who earn more over their lifetimes receive a proportionally smaller amount compared to those who earned less.

I’ll save more later in my career when I’m earning more

Right. That’s like me telling my wife that I’ll give up Dr. Pepper once I finish the last can in the fridge. She just rolls her eyes, knowing I’ll always find a way to sneak one here and there.

The promise of saving more later is rarely fulfilled. Part of the reason is because of something called “lifestyle creep,” where our spending habits tend to increase as our salary increases as well. Don’t believe me? Look at the car you drove in college and the car you’re driving now and ask yourself, “Can’t I still get to and from work in an old beater, similar to the one I had in college?”

I enjoy work and don’t plan to retire

That’s great, I don’t plan to retire either. That is of course, until I can’t do my work anymore. There’s no guarantee that you’ll stay healthy the rest of your life. Few people work and then one day drop dead in their office (Plus, even if you could do that, doesn’t it sound kind of awful?) Illnesses, ailments, and handicaps can slowly impede us or sweep in suddenly, forcing us out of the workforce.

Solving the retirement crisis isn’t done through total reliance on welfare programs, procrastination, or assuming we can work until we’re dead. It’s about spending a career earning money to provide for our families and setting aside some of that money to take care of ourselves (and, arguably, our children as well, since they will be our financial caretakers if we’re broke.)

These are different days. Pensions are dead. Our retirement is up to us now, and based on the numbers we’re not doing a great job.

Chart footnotes

1) http://www.bls.gov/news.release/pdf/wkyeng.pdf

2) https://www.fidelity.com/viewpoints/retirement/how-much-money-do-i-need-to-retire

3) http://www.fool.com/retirement/general/2016/03/21/the-average-american-has-this-much-saved-for-retir.aspx