In the past I’ve talked about the importance of rebalancing and changing your asset allocation as you approach retirement. Making these tiny but crucial “course corrections” is a very important step in the retirement saving process, but it can take time and be a bit complicated, depending on how many investments you have to work with.

Wouldn’t it be nice if there was a service that would change your 401(k) asset allocation for you--automatically?

Well don’t fret, my friends. That time is now, and the “service” actually comes in the form of a mutual fund. Target Retirement Funds carry all the same traits as other mutual funds AND make your investment adjustments automatically. Their “auto-pilot” nature is making them a favorite investment of retirement savers--especially in 401(k)s.

But when you get into the details of these funds, you may find that they’re not as great as they seem. There are some trade-offs that every investor should be aware of when choosing a Target Retirement Fund.

What is a Target Retirement Fund?

What do you see when you look at the name of a mutual fund in your 401(k)? In most cases, the mutual fund will be called something like “XYZ Company Large Cap Value Fund” or “ABC Corp U.S. Fixed Income Fund.” It’s all Greek to many investors, but knowing what’s going on in your 401(k)’s mutual fund investments is important to understand.

Most mutual fund names contain at least some clues describing what the fund invests in. A “large cap value fund” for example, would primarily invest in large cap companies which aren’t seeking huge growth, but rather seek to preserve their value for investors and continue to pay a dividend.

Target Retirement Funds send a clearer message of what they actually do. If you have Target Retirement Funds available in your 401(k), you’ll probably see them listed in this way:

XYZ Company Target Retirement 2020 Fund

XYZ Company Target Retirement 2025 Fund

XYZ Company Target Retirement 2030 Fund

XYZ Company Target Retirement 2035 Fund

As you probably guessed, each of these mutual funds correspond to a particular retirement year. They tend to be available in 5 year increments, and at the time of this writing there are Target Retirement Funds out to year 2065 or even further.

Choosing the “Target Retirement 2020 Fund” would mean you plan to retire around the year 2020 approximately. Choosing “Target Retirement 2050 Fund” would mean you’re planning to retire around the year 2050.

How Do Target Retirement Funds Work?

So how does one Target Retirement Fund differ from another? Or to put it another way, how might the Target Retirement 2020 Fund invest differently than the Target Retirement 2050 Fund?

The main principle behind asset allocation is that as your retirement draws closer, your allocation should gradually shift from more risky investments--like stocks--toward less risky investments--like bonds. An investor is taking an awfully high amount of risk if they’re 60 years old and 5 years away from retirement, but their 401(k) is invested 100% in stock mutual funds. This may have been an acceptable amount of risk when you were 23 years old and fresh out of college, but as you approach retirement most investors start thinking about capital preservation and less about capital gains!

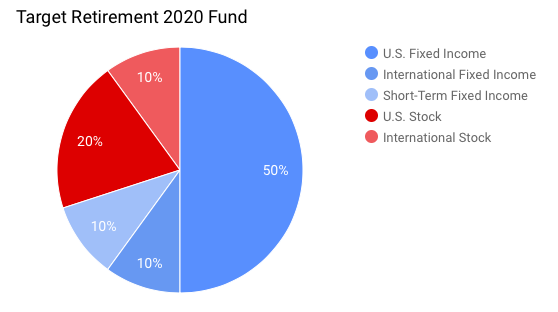

As a result, a Target Retirement 2020 Fund may look something like this.

On the other hand, you might see in a Target Retirement 2050 Fund an allocation like this. Notice the shift away from more risky investments in the 2020 fund.

By now you probably know that mutual funds are investments made up of a variety of individual company stocks and bonds, or government securities like Treasury bills. What you receive with a mutual fund is a extremely well-diversified portfolio of many investments wrapped up into one mutual fund.

So Target Retirement Funds are made up of the same stuff too, right? Sort of. Target Retirement Funds tend to actually be made up of other mutual funds, rather than individual stocks and bonds. Trippy, isn’t it? Having a Target Retirement Fund made up of, say, ten different mutual funds makes it an easier investment for the Fund Family (like Fidelity, Vanguard, or American Funds) to manage. Instead of buying or selling hundreds or thousands of individual investments to adjust the allocation of the fund, they buy or sell ten or twenty different mutual funds.

What’s Not to Like About Target Retirement Funds?

At this point there probably isn’t much to dislike about Target Retirement Funds. They are available in an increasing number of 401(k) plans, they adjust their allocations for you as you get closer to retirement, and in most cases you only have ONE mutual fund to pick when you set up your 401(k) (assuming they’re available to you). But there are two negative attributes of Target Retirement Funds that you should be aware of.

Watch our for the fees

First, remember that instead of you adjusting your allocations over time, the mutual fund will automatically do it for you. That’s mostly true. There isn’t a magic button that gets pressed every five years to adjust your investments. Instead, Target Retirement Funds have a group of financial nerds who make the adjustments (sorry, they’re called Fund Managers).

However, they’re not doing this out of the kindness of their hearts. There’s a fee. In fact, one of the first concerns about Target Retirement Funds are that they tend to be more costly to manage than other mutual funds. For many investors, this is just the cost of convenience, but remember those fees can really add up.

Not all investors have the same risk tolerance

The second concern is an even bigger one. One attribute on Target Retirement Funds is they assume a certain allocation based on when you plan to retire. So if one thousand 25-year-old investors were lined up, and they all planned to retire in 40 years, they could all be fully invested in the same Target Retirement Fund. This assumption is dangerous, and it comes down to one fact: not everyone’s risk tolerance is the same.

When someone plans to retire is only one part of the investment equation. Any financial advisor, before helping someone choose their investments, will conduct an assessment to help determine the investor’s tolerance for risk.

If the investor is 25 years old and wants to retire in 2050, but refuses to accept any degree of investment risk, then a Target Retirement 2050 Fund would be an incredibly inappropriate investment for them. Target Retirement Funds don’t account for variations in risk tolerance; therefore, if you plan to use a Target Retirement Fund in your 401(k), first use a few tools from your 401(k) plan administrators website to determine how risky you're actually willing to be.

I hope this article has helped you understand how Target Retirement Funds work and some of their attributes to look out for. As with anything, there’s no silver bullet, no “snake oil” cure to a hearty, healthy 401(k) throughout retirement. Still, for many investors, Target Retirement Funds are a big step forward in making investing an easier experience.

I’d love to get an idea of how many readers out there have Target Retirement Funds in their 401(k)s. If these investments are available to you, let me know in the comments. Have you chosen to invest in them? What questions do you have which I may not have covered here?